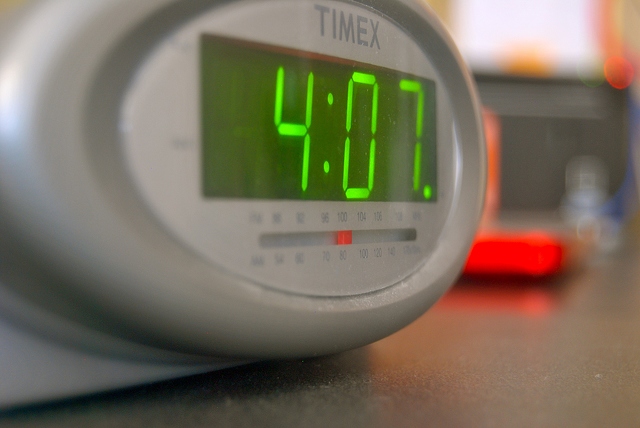

Clock Ticks For Innovative Finance ISAs: Now Is The Time To Act

The end of the tax year is approaching and you must use your ISA allowance by midnight on 5 April or you will lose it. The ISA allowance for 2020/21 is £20,000 if you are a UK taxpayer.

The end of the tax year is approaching and you must use your ISA allowance by midnight on 5 April or you will lose it. The ISA allowance for 2020/21 is £20,000 if you are a UK taxpayer.

The Money&Co. Innovative Finance ISA allows you to receive interest on your loans completely tax free. Since Money&Co. started lending on 29 April 2014, we have achieved an annualised return (net of fees and bad debts) of 7.34% per annum. According to our calculations: over the same period, the FTSE 100 has returned nothing and the FTSE All-Share has returned just 5% over the entire period against a cumulative return from Money&Co. of 64%.

If you do not have a Money&Co. ISA and you would like to open one, please click on the green tab at the side of the home page at www.moneyandco.com and it will take five minutes to open one. You will need your NI number.

Latest ISA-Eligible Loan Offers

Bonnington Law has an A-rating and the annual rate of interest will be 7 per cent. The term of the loan is 12 months. The offer is currently 89 per cent filled. Other offers are scheduled to land on site very shortly.

As regular readers and lenders will be aware, Money&Co. has a very conservative credit-rating and vetting policy. We choose our borrowers and their sectors very carefully, and look for guaranteed income streams and strong asset backing.

One of the areas that we have focused on over the last couple of years is litigation funding. This has proved to be very resilient during the pandemic and so we are today launching an auction for a London-based legal firm called Bonnington Law. Please note that this is a code name, used for commercial reasons.

Bonnington Law focuses on litigation relating to financial mis-selling and was a leading firm during the days of PPI claims. There are still some PPI claims continuing but at a very low level and the new area that requires funding is Plevin. Plevin is related to PPI in that the courts have determined that if a lender persuaded a borrower to take out a PPI policy and did not disclose the commission that it was being paid by the insurance company, then the borrower is potentially entitled to receive the commission and accrued interest. This means that there is a whole raft of people who have already made a PPI claim who can now make a Plevin claim. Bonnington Law is looking to borrow £300,000 from Money&Co. lenders to purchase and fund Plevin claims. It has already successfully settled 1,700 Plevin claims over the last couple of years and is looking to run up to 10,000 Plevin claims per annum over the next three years. You can access a note providing more detail through the auction page.

Money&Co. lenders will be secured on the Plevin claims that will be purchased and Bonnington Law has also agreed to provide 25% more claims in addition. Thus, Money&Co. lenders will have total security of £375,000, giving a loan to value of 80%.

This loan is eligible for inclusion in an Innovative Finance ISA which will allow you to receive the interest, after deduction of Money&Co.’s 1% fee, free of tax. If you do not have an Innovative Finance ISA and would like to open one, please click on this link. If you have not used your ISA allowance for 2020/21, you must do so by midnight on 5 April.

In an environment where base rates are only 0.1%, we consider that a gross yield of 7% per annum is attractive, especially if the loan is held in an Innovative Finance ISA. But please always remember, there is no profit without risk of loss – see risk factors on site, and as set out below.

Historical Performance And IFISA Process Guide

- Money&Co. lenders have achieved an average return of more than 8 per cent gross (before we deduct our one per cent fee).

That figure is the result of over £26 million of loans facilitated on the site, as we bring individuals looking for a good return on capital together with carefully vetted small companies seeking funds for growth. Bear in mind that lenders’ capital is at risk. Read warnings on site before committing capital.

- Money&Co. has been lending for over 5 years and has only had two bad debts so far, representing a bad debt rate of 0.03 per cent per annum.

All loans on site are eligible to be held in a Money&Co. Innovative Finance Individual Savings Account (IFISA), up to the annual ISA limit of £20,000. Such loans offer lenders tax-free income. Our offering is an Innovative Finance ISA (IFISA) that can hold the peer-to-peer (P2P) business loans that Money&Co. facilitates. For the purposes of this article, the terms ISA and IFISA are interchangeable.

So here’s our guide to the process:

- Step 1: Register as a lender. Go to the login page, and go through the process that the law requires us to effect. This means we have to do basic checks on you to comply with money-laundering and other security requirements.

- Step 2: Put money into your account. This is best done by electronic transfer. We can also process paper cheques drawn in favour of Denmark Square Limited, the parent company of Money&Co.

- Step 3: Buy loans in the loan market. Once you’ve put cash in your account it will sit there – and it won’t earn interest until you’ve bought a piece of a loan. It’s this final step that requires lenders and IFISA investors to be pro-active. Just choose some loans – all loans on the Money&Co. site can be held in an IFISA – and your money will start earning tax-free interest.

The ISA allowance for 2020/21 is unchanged from last tax year at £20,000, allowing a married couple to put £40,000 into a tax-free environment. Over three years, an investment of this scale in two Money&Co. Innovative Finance ISAs would generate £8,400 of income completely free of tax. We’re assuming a 7 per cent return, net of charges and free of tax here.

Once you have made your initial commitment, you might then consider diversifying – buying a spread of loans. To do this, you can go into the “loans for sale” market. All loans bought in this market also qualify for IFISA tax benefits.

Risk: Security, Access, Yield

Do consider not just the return, but the security and the ease of access to your investment. We write regularly about these three key factors. Here’s one of several earlier articles on security, access and yield.